A company’s ability to consistently pay and increase dividends is often a strong indicator of its financial health and stability. Companies that generate sufficient profits and cash flow are more likely to distribute dividends to their shareholders. Therefore, a stable or growing dividend yield can be a signal that a company is in good financial standing. As investors in the stock market, it is often a subject for contemplation that some stocks are able to deliver higher returns in terms of dividends to their investors in comparison to others.

- Dividend yield allows you to compare the dividend payments of different companies and better evaluate them as investments.

- Yet over the past 13 years, Mastercard has proven to be the far better investment with 1,940% in total returns, more than 4 times the 419% American Express has delivered.

- One of the most popular is Realty Income (O 2.0%), which we can use as an example.

- It should be noted that dividends are not guaranteed and can change if a company runs into financial issues or decides to use its capital for another purpose, such as an acquisition or to pay down debt.

Do all stocks pay dividends?

This is especially important because some companies pay uneven dividends, with the higher payouts toward the end of the year, for example. So you wouldn’t want to simply add up the last few dividend payments without checking to make sure the total represents an accurate annual dividend amount. Dividend payments are expressed as a dollar amount, and supplement the return a stock produces over the course of a year. For an investor interested in total return, learning how to calculate dividend yield for different companies can help to decide which company may be a better investment.

More Dividend Resources from MarketBeat

As a result, firms will never want to adjust their short-term liquidity to woo investors and shareholders. Generally, dividends are paid, indicating that they are in complete control of their liquidity position. Once its current liabilities are paid off, only then can a firm be in a position to offer dividends to its shareholders. As noted earlier, a dividend is a way for a company to distribute some of its earnings among shareholders. Dividends can be paid monthly, quarterly, semi-annually, or even annually (although quarterly payouts tend to be common in the U.S.).

Personal Loans

SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Hence, it is important to check the payout ratio before you make your decision. Company A is likely to become more profitable and, therefore, increase the dividend payout to shareholders.

Because of how dividend yield is calculated, the yield is higher as the stock price falls, so it’s important to evaluate whether there has been a downward price trend. Often, when a company is in trouble, one of the first things it is likely to reduce or eliminate is that dividend. Companies with higher dividends are often larger, more established businesses.

Total return

The dividend yield is an estimate of the dividend-only return of a stock investment. Assuming the dividend is not raised or lowered, the yield will rise when the price of the stock falls. REITs are in the business of managing portfolios of property investments, and they are required by law to issue dividends equal to at least 90% of their taxable income each year. On paper, it would look like the stock’s dividend yield had risen dramatically — from around 6.5% — but not for reasons that investors might like. However, when calculating an annual dividend yield, you have to decide what period to look at. We believe everyone should be able to make financial decisions with confidence.

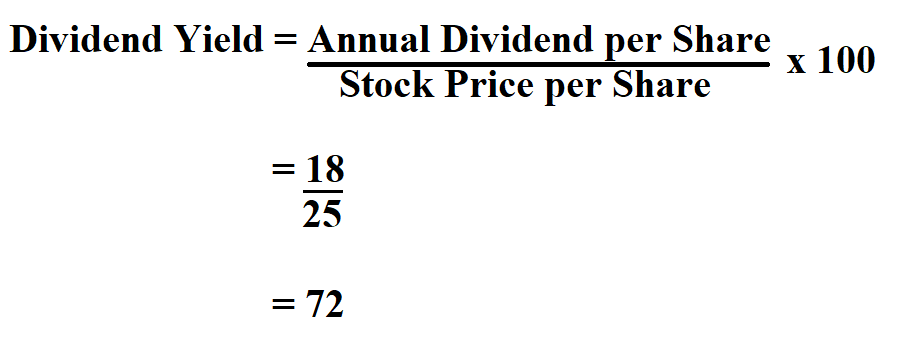

Dividend yield is one way for long-term investors to decide if a stock is worth buying. Use the MarketBeat dividend yield calculator to evaluate the dividend yields for different stocks. Value investors consider a high dividend yield ratio as a strong value indicator.

In contrast some investors may find a higher dividend yield unattractive, perhaps because it increases their tax bill. For example, if you own $20,000 of stock of a company with an annual dividend yield of 5%, you would receive $1,000 in dividend payments for the year. Dividend yield shows how much a company pays its shareholders in dividends annually per dollar invested. It reflects how much an investor will earn aside from any capital gains in the stock.

Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. Our partners cannot pay us to guarantee favorable reviews of their products or services. For example, an investor looking goodwill as an intangible asset to make optimum usage from the client’s portfolio to supplement their income will prefer the portfolio of Company A as it has a higher yield than Company B. Qualified dividends are dividends from shares which have been held for a set minimum time period.

This means Company A’s dividend yield is 5% ($1 ÷ $20), while Company B’s dividend yield is only 2.5% ($1 ÷ $40). Assuming all other factors are equivalent, an investor looking to use their portfolio to supplement their income would likely prefer Company A over Company B because it has double the dividend yield. Dividends can help generate some income from your portfolio without selling stock.