HELOC and Domestic Guarantee LoanWhat will they be, and you will what type is best for you?

Yet another home together with the most recent gizmos would-be sweet, would it? Maybe this is the time regarding remodeling endeavor you’ve been dreaming about.

Maybe your son or daughter is getting married, and you are buying the wedding. Or possibly you would like a hefty lump sum of cash having something else entirely.

While a homeowner that has been while making mortgage payments having the past several years, then you have probably the means to access the amount of money to simply help spend of these big investments. We have been talking about a property security line of credit (HELOC) or a home guarantee financing. They are both well-known possibilities due to the fact a handy and regularly quick way to pay for large costs.

The newest collateral of your home is the difference between the current market value of your property and exactly how far you borrowed from to the your mortgage. Deduct how much cash your debt regarding the really worth and also the variation will be your equity. Loan providers will let you borrow against so it huge difference.

You might borrow against the latest collateral in your home utilizing your house since the security for money you acquire, says Alan LaFollette, Controlling Movie director initially National Lender from Omaha.

That’s what produces HELOCs and you can home equity funds distinctive from a great personal loan: Your home is the fresh new security. And therefore the fresh new security expands one another since you pay down your home loan incase the Candlewood Knolls loans fresh house’s really worth goes up.

HELOCs and household collateral finance are also named 2nd mortgages. However, one another funds usually are having reduced words like, 10 or fifteen years versus a primary mortgage, which is normally to own three decades.

Good HELOC work similar to a credit card, which have a revolving personal line of credit, claims LaFollette. Youre given a credit line which can be found to own that use of getting a flat timeframe, and that is doing a decade. You might withdraw money as you need they using a check otherwise an excellent debit cards attached to you to membership. (Note: Only a few states create access to an excellent debit credit so you’re able to withdraw of a good HELOC. Speak to your lender to stick in the event it is let.)

Likewise, a property collateral loan are a phrase financing in which you borrow a-one-day lump sum payment. Then you pay-off one to lump sum payment more than a pre-determined amount of time during the a fixed interest toward same repeating monthly installments.

Acquiring a HELOC is an excellent alternative when you are considering a makeover to possess an out-of-date kitchen area, a bathroom redesign otherwise an extension to your house. Either significant home improvements, such as your bathroom remodel, may cause a rise in their residence’s value.

Whether a good HELOC is actually for a property improvement otherwise a big experiences that you experienced such as for example a marriage or college degree expenses, a good HELOC otherwise home security mortgage may still end up being the finest selection for borrowing from the bank currency. Borrowing limitations usually are highest and you may rates are typically straight down when comparing to a leading-rate of interest bank card.

It relies on some things; first off, the value of your house. Loan providers generally cap the amount you could potentially use during the 80-85% of one’s security of your house.

Nerdwallet plus states you generally have to have a credit rating of at least 620 plus the family must be respected on ten-20% more your debts into the financial. Money and you will personal debt-to-income ratios are also issues.

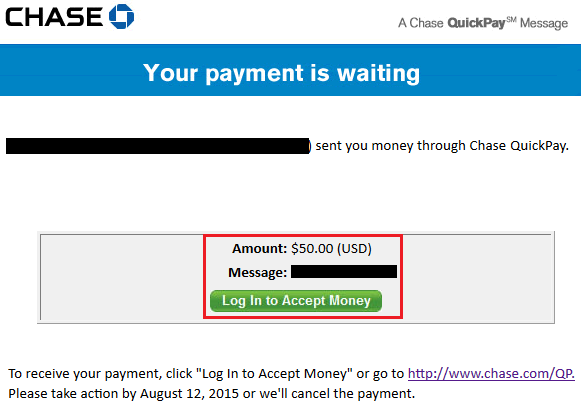

You have property that has a recent market price off $250,100 which have an equilibrium off $150,100000 on the financial. Their lender allows you to availability doing 80% of the house’s mortgage-to-worthy of guarantee.

HELOC and you can House Security LoanWhat are they, and you may what type is best for you?

- $250,100 x 80% = $two hundred,100000

- $two hundred,one hundred thousand – $150,one hundred thousand = $50,000

- $50,100 is how higher the credit line will be which have a good HELOC otherwise simply how much you could borrow to own property guarantee loan.

Meaning you can make particular big home improvements on your own family, machine a very sweet marriage for your son or daughter, or explore that money with other highest investments, for example settling big credit card debt otherwise helping pay to suit your children’s degree will cost you.

If you’re there are a few positive points to taking out fully a beneficial HELOC or a property security mortgage, there are also certain important components to adopt:

HELOC and you may Household Security LoanWhat are they, and you may what type is best for your?

- For people who borrow cash from the guarantee of your home and home values disappear before you could have the ability to pay it back, you could end up owing more than your home is worthy of. This will be called getting underwater along with your home loan, an issue which was common in the houses crash of 2008, when borrowers have been trapped within the property they may not sell just like the its opinions sank.

- Please remember, if you possibly could no further create payments into loan, then you chance your house entering foreclosure since your domestic ‘s the guarantee to the loan.

HELOC and you can Family Security LoanWhat are they, and which is best for you?

- What are the rates of interest?

- When the interest levels rise or off, exactly how much often my personal money feel?

- Just how long ‘s the label from my personal home equity loan?

- How long perform I must pay it back?

- Is my personal line of credit sustainable in the event the mortgage ends?

In addition to talking-to your lender, it’s wise to see an income tax advisor or monetary coordinator just who might help discuss an informed choices for your.