If you start off with only a handful of accounts and then keep expanding the list as your business grows, it may become increasingly challenging to compare financial results against the previous years. On the other hand, organizing the chart with a higher level of detail from the beginning allows for more flexibility in categorizing financial transactions and more consistent historical comparisons over time. And even within the manufacturing line of business, a manufacturer in the aerospace sector will have a much different looking chart of accounts than one that produces computer hardware or even clothing apparel. Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

List: How Do You Create a Chart of Accounts?

Acting as the financial DNA of business accounting, it provides a detailed directory of various accounts essential for financial accounting practices. It encompasses all financial activities within an organization, with each account representing a distinct category – such as revenue, expense, or asset. Although the structure of a COA may vary to accommodate a business’s size, industry, and specific needs, its primary goal is to offer a clear and comprehensive 15 tax deductions and benefits for the self view of the organization’s financial health. Analyzing a balance sheet typically involves understanding the company’s liquidity, solvency, and overall financial health. For example, comparing current assets and current liabilities can help determine a company’s liquidity, or its ability to cover short-term obligations. A high current ratio (current assets / current liabilities) indicates that a company can easily pay its short-term debts.

Create business account names

The chart of accounts serves as the foundational framework used to generate the financial statements for a business. These financial statements, which include the balance sheet, income statement, and cash flow statement, are the principal reports a company relies on for making informed decisions. While the chart of accounts can be similar across businesses in similar industries, you should create a chart of accounts that is unique to your individual business. You should ask yourself, what do I want to track in my business and how do I want to organize this information? For example, we often suggest our clients break down their sales by revenue stream rather than just lumping all sales in a Revenue category.

Income

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. It’s not always fun seeing a straightforward list of everything you spend your hard-earned money on, but the chart of accounts can give you an important view of your spending habits. You can get a handle on your necessary recurring expenses, like rent, utilities, and internet.

Add financial statements

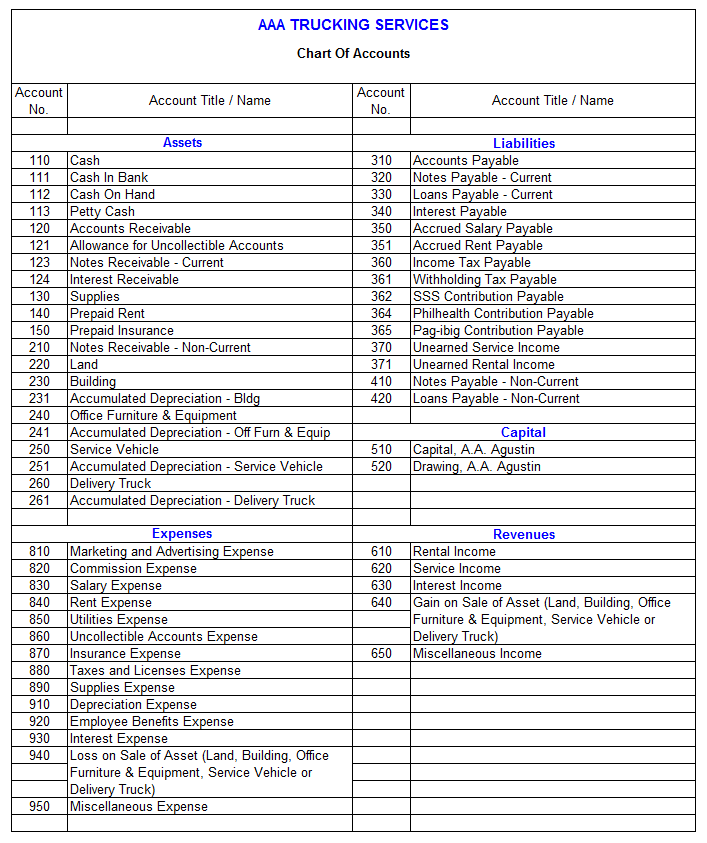

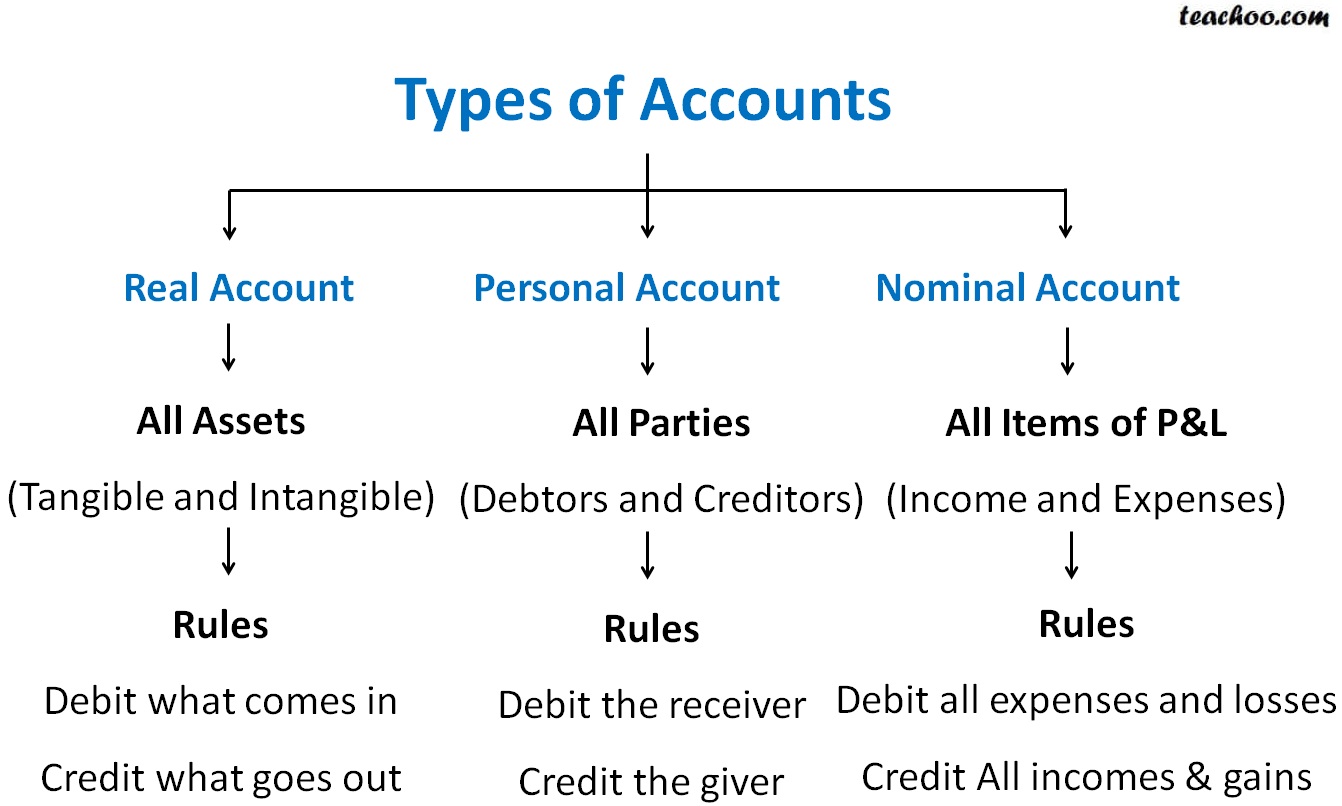

You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. The purpose of the code is simply to group similar accounts together, and to provide an easy method of referring to an account when preparing journal entries. When allocating account codes (chart of accounts numbers) don’t forget to leave space for additional accounts and codes to be inserted in a group at a later stage.

Best Accounting Software for Small Businesses of 2024

It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized. A chart of accounts is an important organizational tool in the form of a list of all the names of the accounts a company has included in its general ledger. This list will usually also include a short description of each account and a unique identification code number.

- As part of the equity accounts, retained earnings serve as an indicator of the company’s financial health and its capacity to generate profits for continued growth.

- A chart of accounts gives you a clear picture of how much money you owe in terms of short- and long-term debts.

- This categorization goes beyond merely adhering to accounting standards; it aligns with your business’s operational needs.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Examples of current assets are cash, marketable securities, inventory, and accounts receivable, all of which play a critical role in managing the day-to-day financial operations of a business. The general ledger serves as the central repository for all of a company’s financial transactions. Each account listed in the chart of accounts (COA) has a corresponding ledger account in the general ledger. Financial transactions are recorded in the appropriate ledger account, as dictated by the COA’s categorization, ensuring that transactions are organized and tracked systematically. The classification of assets and liabilities into current and non-current categories helps businesses and investors assess the financial health of a company.

Yes, a clear and logical COA can streamline the audit process by making it easier to trace transactions and validate financial statements. Design it with transparency and compliance in mind, aligning closely with accounting standards. Ensure the COA structure is compatible with the software, use standardized account numbers and names, and regularly review the integration for any updates or changes in business processes. Regularly back up your data and perform test runs before finalizing any changes or updates to the COA within the accounting software. Also consider any security measures needed to protect sensitive financial information stored in the system. This categorization goes beyond merely adhering to accounting standards; it aligns with your business’s operational needs.