- House value features dipped from the top at the outset of 2024. According to National Connection out of Real estate professionals (NAR)is the reason Cost List Report, the newest cost directory has come down seriously to 95.nine, height out of 105.seven. Even you to definitely highest part are significantly less than 2021’s affordability index away from 148.2. (Federal Association from Real estate agents)

- Simply 19% of consumers trust it is already a lot of fun to purchase an excellent domestic. That being said, it show reflects an enthusiastic uptick out of fourteen% for the . (Fannie mae)

- Customer care which have lenders was at a practically all-big date large. Centered on data out of J.D. Fuel, overall customer satisfaction which have lenders is at 730 of 1000 inside 2023, right up fourteen activities throughout the year past. (J.D. Power)

Just how can Mortgage loans Functions?

Per month, the original amount away from what you shell out goes to any appeal which is accrued because your last commission. Whatever’s left would go to paying your loan equilibrium (what lenders label prominent).

- If you have a fixed-speed mortgage, the amount you can pay per month to your dominating and you will focus never ever change.

- When you have an adjustable-price mortgage (ARM), their monthly payment can move up or down. So it transform goes from the intervals outlined in your mortgage, constantly every six months or per year. In the event the commission goes up otherwise off depends on new index to which your home loan was tied. A lot of loan providers utilize the Covered Right-away Money Rate (SOFR), such as.

- When you yourself have a hybrid Arm, the payment remains repaired on basic element of their loan (constantly, 5 so you can 7 ages). Following, they changes in order to a variable-speed mortgage, along with your price changes upcoming since revealed on your own financing terms and conditions.

No matter which variety of financial you really have, your house serves as equity. That means that for people who stop to make the mortgage repayments to own a little while, your bank is also seize our home.

Sorts of Mortgages

An informed mortgage businesses usually give a number of different varieties of mortgage loans. So you can navigate your alternatives, we will give you a fast overview of the most common groups out-of home loan fund:

Compliant loans

Each year, this new Federal Housing Funds Agency (FHFA) lies out a limit to possess loan number. These differ dependent on where you happen to live, which have higher-cost portion providing high ceilings. For almost all of the nation, even in the event, the newest FHFA maximum for 2024 was $766,550 having an individual-home.

If you get a mortgage this is simply not more than your area’s FHFA limit, it’s named a compliant mortgage. Certain government-recognized loans was compliant finance. If your mortgage doesn’t have government support, it’s called a normal conforming mortgage.

Nonconforming financing

If you want to discuss new FHFA’s limit otherwise want to behave else bizarre-for example get an appeal-simply financing-your home loan would-be non-conforming. Home loan lenders essentially consider these financing high-risk, so you’ll be able to always pay way more inside the appeal if you go this station.

Government-supported money

Particular federal agencies give to face at the rear of fund. Whether your debtor concludes make payment on lender right back, you to definitely institution will assist the lending company recover a few of the will set you back. Which setup lowers the chance to have home loan organizations, very government-supported fund have advantages such as for example down rates of interest and a lot more everyday credit standards.

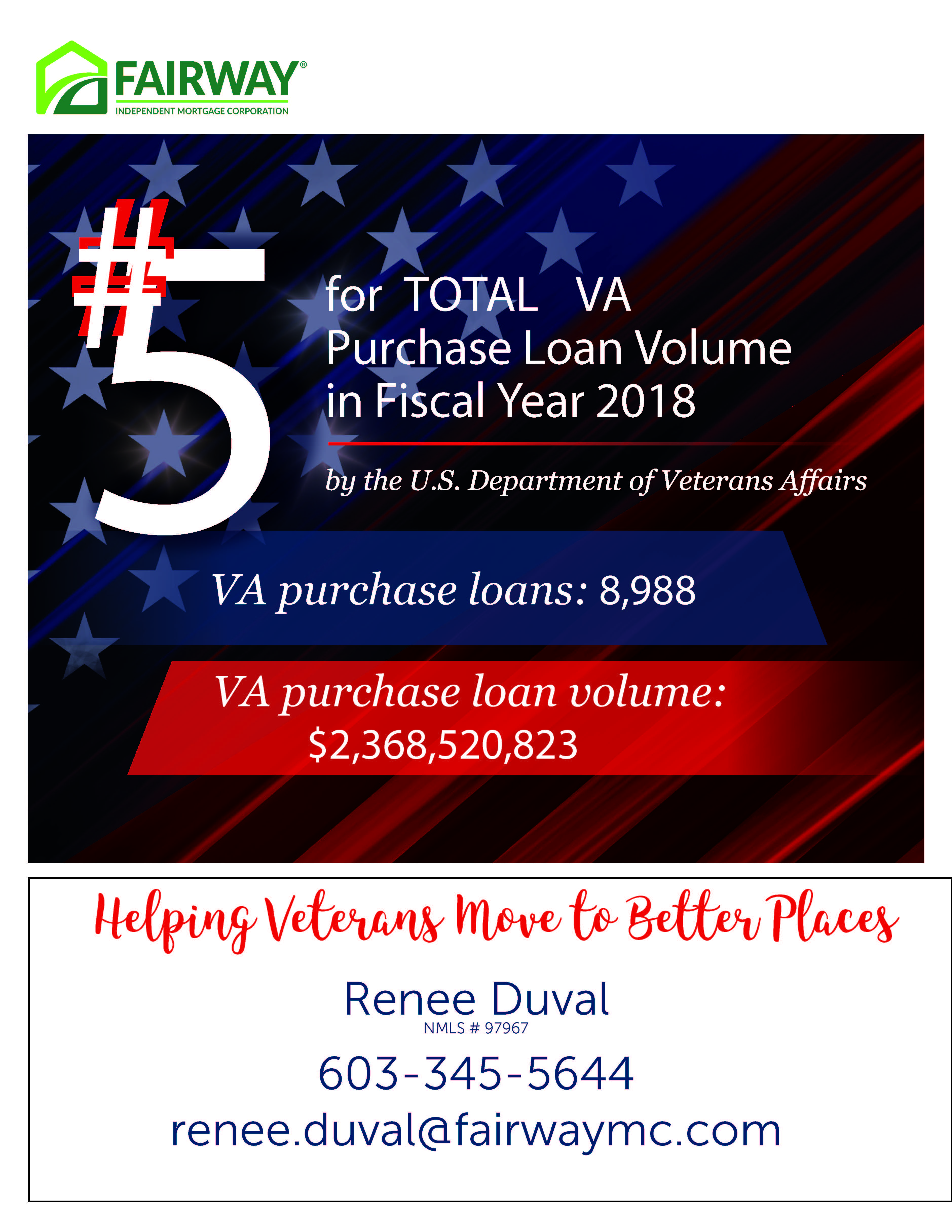

- Va fund. The fresh new Institution off Pros Things (VA) backs such funds to have active-obligations armed forces team and you may veterans exactly who fulfill a minimum service needs. Va money don’t require any down payment.

- FHA financing. This new Federal Property Management (FHA) stands behind these types of money to help consumers exactly who you https://elitecashadvance.com/installment-loans-tx/ are going to or even be struggling to rating resource. You could potentially qualify for an FHA financing that have a card rating only 500 if you’re able to put ten% down.