For asset-heavy industries, BVPS might provide a reasonable estimate of value. However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading.

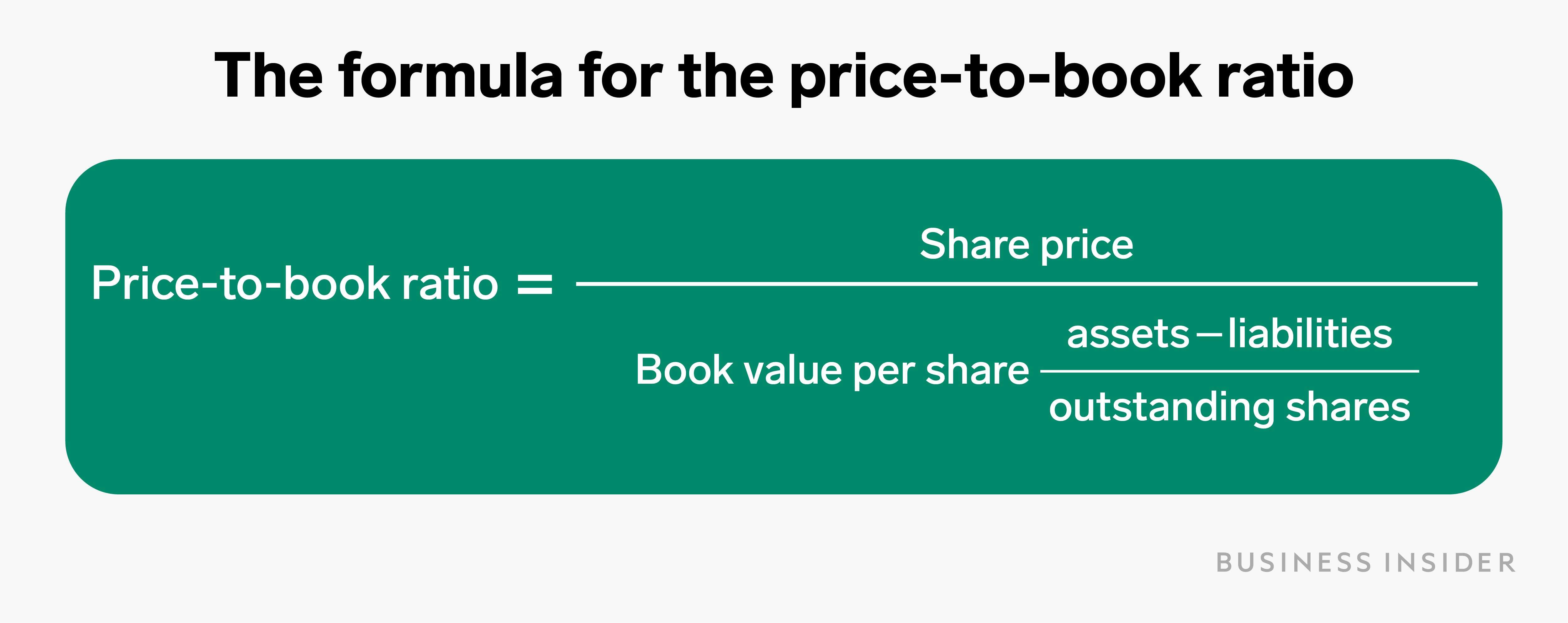

Formula to Calculate Book Value of a Company

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Companies that store inventory in a warehouse can count all of that inventory toward their book value. However, tech companies that specialize in creating software don’t have an asset that is stored somewhere, and they don’t require expensive industrial equipment to produce their product. They may generate sales with that software, but there isn’t a warehouse full of software code that investors can look at to gauge future sales. One limitation of book value per share is that, in and of itself, it doesn’t tell you much as an investor. Investors must compare the BVPS to the market price of the stock to begin to analyze how it impacts them.

Book Value Per Share vs Market Value Per Share

Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. A common way of increasing BVPS is for companies to buy back common stocks from shareholders. This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided. For example, in the above example, Company X could repurchase 500,000 shares to reduce its outstanding shares from 3,000,000 to 2,500,000. The good news is that the number is clearly stated and usually does not need to be adjusted for analytical purposes.

Companies Suited to Book Value Plays

- The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

- Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays.

- On the other hand, a declining book value per share could indicate that the stock’s price may decline, and some investors might consider that a signal to sell the stock.

- Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

Value investors use BVPS to identify stocks that are trading below their intrinsic value, indicating potential undervaluation. While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of. Conversely, if the market value per share exceeds BVPS, the stock might be perceived as overvalued. BVPS offers a baseline, especially valuable for value investors looking for opportunities in underpriced stocks. The difference between book value per share and market share price is as follows. The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently.

Book Value, Face Value & Market Value – Video Explanation

For example, the company’s financial statements, competitive landscape, and management team. You also need to make sure that you have a clear understanding of the risks involved with any potential investment. The next assumption states that the weighted average of common shares outstanding is 1.4bn. It’s important to use the average number of outstanding shares in this calculation. A short-term event, such as a stock buy-back, can skew period-ending values, and this would influence results and diminish their reliability. In this case, the value of the assets should be reduced by the size of any secured loans tied to them.

What Does Book Value Per Share (BVPS) Tell Investors?

If book value is negative, where a company’s liabilities exceed its assets, this is known as a balance sheet insolvency. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase. Generally, the book value per share is used by investors (especially value investors) to determine whether a share is fairly valued.

However, the market value per share—a forward-looking metric—accounts for a company’s future earning power. As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it.

To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity. If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

As long as the accountants have done a good job (and the company’s executives aren’t crooked) we can use the common equity measure for our analytical purposes. Rather than buying more of its own stock, a company can use profits to accumulate additional assets or reduce its current liabilities. For example, a company can use profits to either purchase more company assets, pay off debts, product owner vs product manager or both. These methods would increase the common equity available to shareholders, and hence, raise the BVPS. Whereas some price models and fundamental analyses are complex, calculating book value per share is fairly straightforward. At its core, it’s subtracting a company’s preferred stock from shareholder equity and dividing that sum by the average amount of outstanding shares.