The cash flows to Company A’s investors would equate to $80 million. So, a company must be profitable before they can start benefiting from the interest tax shield. The interest tax shield relates to interest payments exclusively, rather than interest income.

APV vs. Discounted Cash Flow (DCF)

The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses. The higher the savings from the tax shield, the higher the company’s cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. Tax shields are essentially tools used to protect income from being taxable. They can take different forms, such as deductible expenses, tax credits, or depreciation allowances.

Tax Shields for Depreciation

The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. The payment of interest expense reduces the taxable income and the amount of taxes due – a demonstrated benefit of having debt and interest expense. From running water to corporate subsidies to encourage growth, the services provided by governments are paid for by taxes collected from individuals and corporate entities. However, there are certain ways that corporate finance allows for protection against paying too much in taxes. These are called tax shields, and there are many different types that a good CFO will have as tools at their disposal, including an interest tax shield.

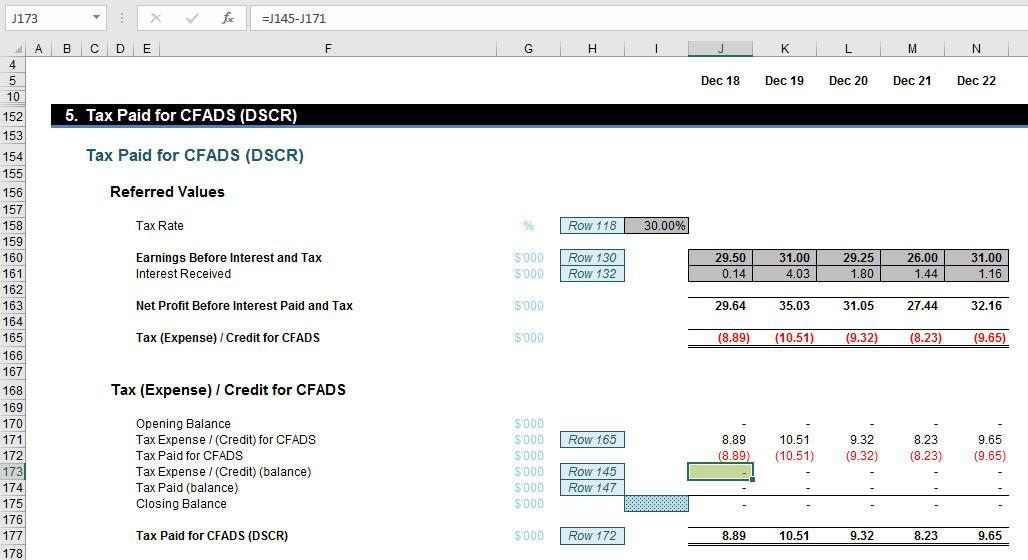

Download CFI’s Free Tax Shield Example Template

As is hopefully clear by this stage, the interest tax shield is just one example of the tax shielding opportunities available to companies. The applicable tax rate can vary depending on your location and the nature of your business. It’s important to use the current tax rate provided by your local tax authority or consult a tax professional to determine the correct rate. Most of these indirect borrowing costs are non-deductible for tax purposes. Although you can take several benefits from the interest tax shield, there are some limitations too. Therefore, always apply for a loan with regular lenders like a commercial bank for taking advantage of the interest tax shield.

Here, we explain the concept along with its formula, how to calculate it, examples, and benefits. You may also look into the related articles below for a better understanding. Another option is to acquire the asset on a lease rental of $ 25,000 per annum payable at the end of each year for 10 years. A company is reviewing an investment proposal in a project involving a capital outlay of $90,00,000 in a plant and machinery. The project would have a life of 5 years at the end of which the plant and machinery could fetch a value of $30,00,000.

- Further, although interest payments on debt are usually tax deductible, the debt still must be paid off.

- It is important to understand how an interest tax shield works, as it is considered to be an essential part of business valuation.

- The third step is to use the formula mentioned above and calculate the interest tax shield amount.

- The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.

Although tax shield can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest and depreciation expenses in a company. Therefore, the tax shield can be specifically represented as tax-deductible expenses. A person buys a house with a mortgage and pays interest on that mortgage.

As we can see, Company A saved $660,000 on taxes due to its interest tax shield. You can also note that the exact difference between the tax liabilities of Company A and Company B is $ 660,000. The third step is to use the formula mentioned above and calculate the interest tax shield amount.

Generally speaking, the higher the retention ratio of a firm, the higher its growth rate. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples. Businesses managing their debt financing well tend to borrow more. They also reap the rewards of paying lower taxes due to the interest tax shield. Both individual and corporate taxpayers can carry forward the remaining interest costs to the next years.

When adding back a tax shield for certain formulas, such as free cash flow, it may not be as simple as adding back the full value of the tax shield. Instead, you should add back the original expense multiplied by one minus the tax rate. This is because the net effect of losing a tax shield is losing the value of the tax shield but gaining back the original expense as income. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible.

In the end, the benefits depend on the cash flow and the overall tax rate of the taxpayer. Governments provide interest tax shields in order to encourage more investments for companies and can you claim your unborn child on your taxes firms, as well as for individuals. The term “Tax Shield” refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.